Industrial Plastic Manufacturing

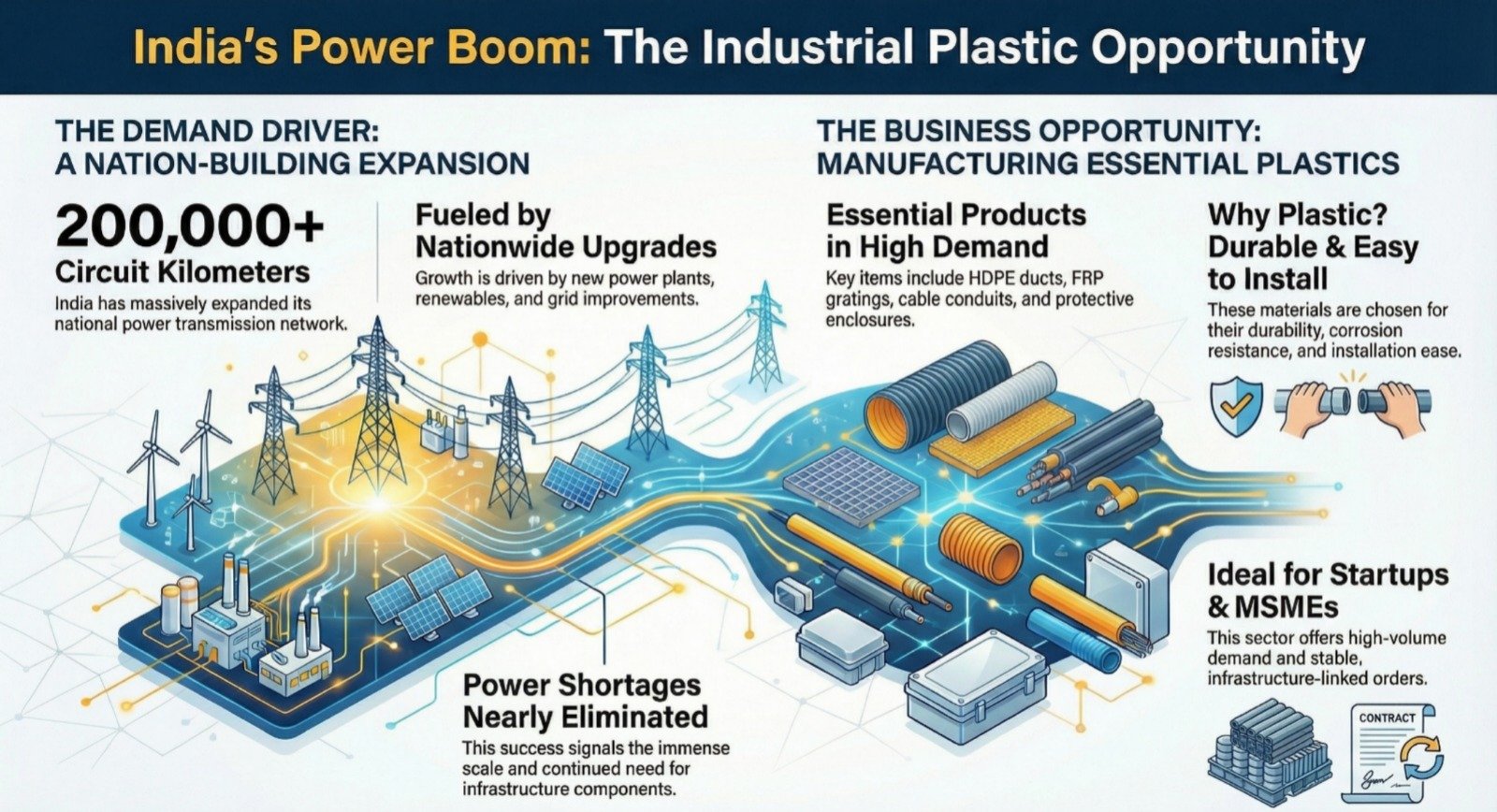

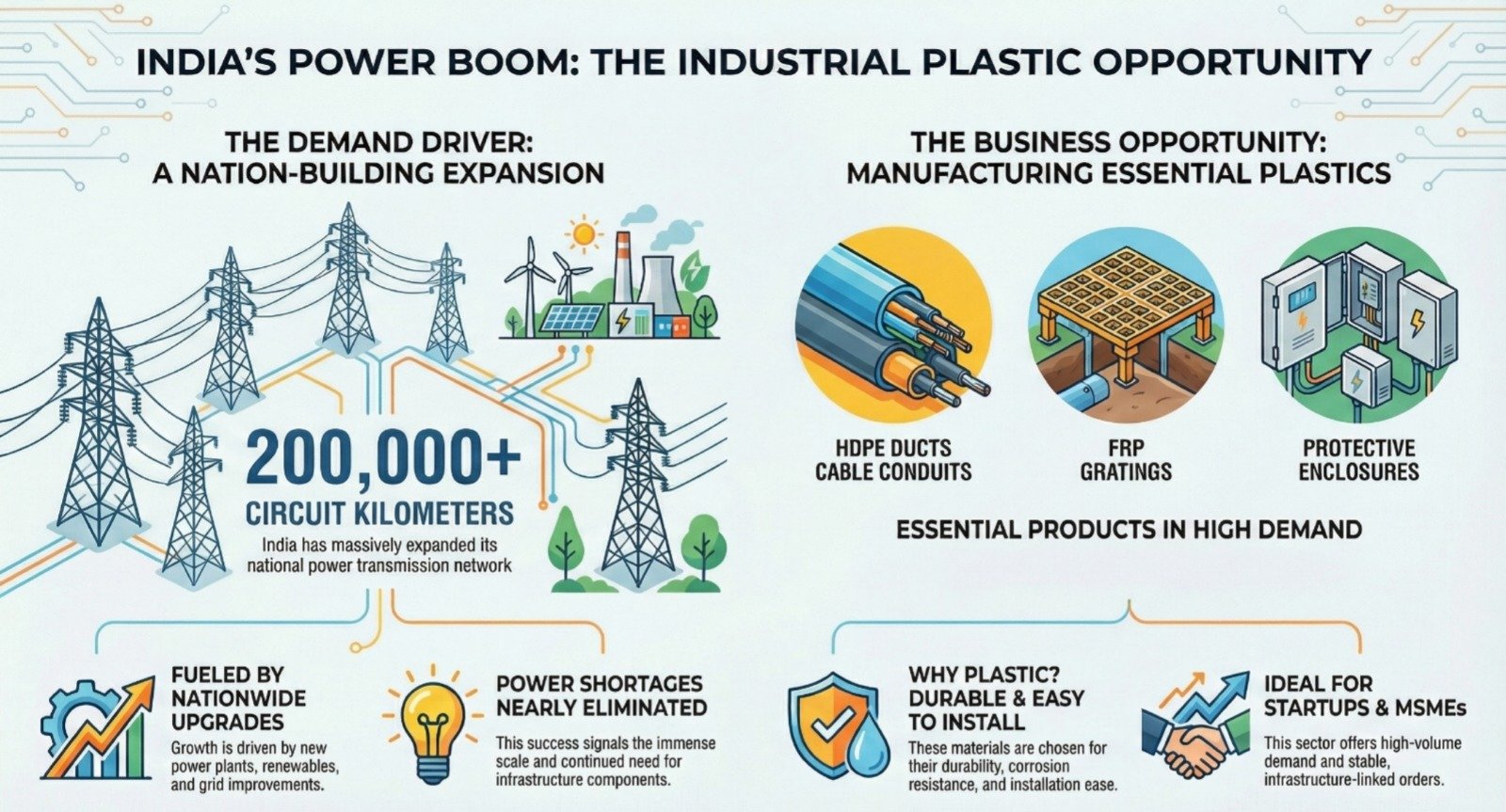

India’s power and energy sector is expanding steadily, driven by new power plants, renewable energy projects, grid upgrades, and distribution improvements. While most discussions focus on electricity generation and transmission capacity, there is a growing business opportunity that often goes unnoticed—industrial plastic products used across power and energy infrastructure.

From power plants and substations to transmission corridors and renewable parks, plastic-based products play a critical role. Items such as HDPE ducts, FRP gratings, cable conduits, and protective enclosures are now essential due to their durability, corrosion resistance, and ease of installation.

As per the Ministry of Power, India has nearly eliminated power shortages, expanded its transmission network beyond two lakh circuit kilometres, and significantly increased transformation capacity. Every new asset created under this expansion requires reliable plastic components, creating long-term demand for manufacturers.

For startups and MSMEs, industrial plastic manufacturing offers a strong mix of high-volume demand, lower maintenance products, and stable infrastructure-linked orders.

Why Power & Energy Projects Prefer Industrial Plastics

Why Power & Energy Projects Prefer Industrial Plastics

Power infrastructure operates in challenging conditions—outdoor exposure, heat, moisture, chemicals, and continuous electrical load. Traditional materials like steel and concrete are increasingly being replaced or supported by engineering plastics and FRP products because they:

- Do not corrode

- Are electrically insulating

- Are lightweight and easy to install

- Have long service life

- Reduce maintenance costs

As power and renewable projects grow in scale and complexity, the demand for reliable plastic solutions continues to rise.

1. HDPE Duct Manufacturing for Power & Telecom Projects

Market Demand

HDPE ducts are widely used for:

- Underground power cables

- Optical fiber networks

- Smart grid communication lines

- Renewable energy evacuation systems

With more cities shifting to underground cabling and large renewable parks coming up, HDPE duct demand is increasing year after year.

Business Opportunity

Some high-specification and multi-duct systems are still imported. Local manufacturing offers clear advantages in cost, faster delivery, and project customization.

Why This Is a Good Startup Business

- Continuous demand from power and telecom sectors

- Proven and standard extrusion technology

- Easy capacity expansion

- Strong government and EPC procurement

Many MSMEs started by supplying regional projects and later expanded to national infrastructure corridors.

2. FRP Gratings Manufacturing for Power Plants & Substations

Market Need

FRP gratings are now widely used in:

- Thermal and hydro power plants

- Substations and switchyards

- Cooling tower platforms

- Chemical and maintenance areas

They are preferred over steel because they are corrosion-resistant, non-conductive, lightweight, and require very little maintenance.

Import Substitution Scope

High-quality, fire-retardant, and custom FRP gratings are still partially imported. This creates a clear opportunity for Indian manufacturers with proper quality control.

Why MSMEs Can Succeed

- Simple molding and fabrication processes

- High value compared to weight

- Strong demand for customized designs

- Long replacement cycles

Manufacturers who meet power-sector safety standards often secure long-term plant contracts.

3. Cable Conduits and Trunking Systems

Market Demand

Plastic cable conduits and trunking systems are essential for:

- Power plants and substations

- Renewable energy projects

- Data centres

- Industrial electrification

With increasing cable density and stricter safety norms, plastic conduits are preferred over metal alternatives.

Business Advantage

Specialised conduits with UV resistance, flame retardancy, and heavy-duty ratings are still limited in domestic supply, offering space for new entrants.

Why This Business Works

- High-volume consumption

- Low technical risk

- Easy product diversification

- Strong repeat demand from EPC contractors

Providing complete cable management systems helps manufacturers lock in repeat orders.

4.Protective Plastic Covers and Enclosures

Market Need

Protective plastic covers are used to safeguard:

- Electrical joints

- Instruments and sensors

- Valves and flanges

- Outdoor equipment

In power and renewable installations, exposure to sunlight, rain, dust, and chemicals makes protective enclosures essential.

Startup Opportunity

India still imports specialised protective housings for sensitive installations. Local fabrication using engineering plastics offers strong growth potential.

Why Startups Can Win

- Custom design capability

- Low tooling investment

- Engineering-driven differentiation

- Export possibilities

Import Substitution Potential in Industrial Plastics

Some industrial plastic products used in power projects still depend on imports, especially:

- High-grade FRP products

- Specialized HDPE duct systems

- Flame-retardant and UV-stabilized plastics

MSMEs that focus on quality testing, certification, and performance reliability can gradually replace imports and build strong domestic brands.

Absolutely! Here’s an additional content section (~1500 words) in the same professional, detailed style as your original article, incorporating the keyword “Industrial Plastic Manufacturing Opportunities” throughout. This section expands on emerging applications, business strategies, market potential, and technological trends.

Industrial Plastic Manufacturing Opportunities in Emerging Energy and Infrastructure Segments

Industrial Plastic Manufacturing Opportunities in Emerging Energy and Infrastructure Segments

India’s Industrial Plastic Manufacturing Opportunities are no longer limited to conventional power and energy projects. With rapid urbanisation, renewable energy expansion, and infrastructure modernisation, industrial plastics are becoming essential in a wide range of applications, including water management, EV charging stations, smart grids, and hybrid energy storage systems. These developments are creating a diverse and growing market for MSMEs and startups in India.

Industrial Plastics in Renewable Energy Infrastructure

The renewable energy sector, including solar and wind projects, is expanding rapidly. Industrial plastics are increasingly being used for:

- Solar panel frames and mounting structures: Lightweight, durable, and corrosion-resistant plastics reduce the need for heavy metals and simplify installation.

- Wind turbine components: FRP and composite plastics are used in nacelles, housings, and protective panels, offering long life under harsh environmental conditions.

- Battery enclosures for energy storage systems: HDPE and FRP are preferred due to chemical resistance, electrical insulation, and fire-retardant properties.

Business Opportunity: Companies can supply standardised modular components or customise products for large renewable parks, offering significant growth potential for MSMEs.

Why This Works:

- Strong demand from both public and private sector renewable projects.

- Relatively low competition in high-quality, specialised components.

- Repeat orders from maintenance and expansion of renewable installations.

Industrial Plastics in Electric Vehicle (EV) Infrastructure

India’s electric mobility sector is creating Industrial Plastic Manufacturing Opportunities for charging infrastructure and vehicle components:

- Cable conduits for EV charging stations: Plastic ducts are increasingly replacing metal conduits due to their lightweight, insulating properties.

- Protective housings for charging points: Weatherproof and corrosion-resistant plastic enclosures improve durability in outdoor environments.

- Battery casings: FRP and engineering plastics ensure safety, chemical resistance, and thermal management.

Market Advantage: EV infrastructure is still in a growing stage, and plastic components are essential for reducing installation and maintenance costs, creating long-term contracts for manufacturers.

Why MSMEs Can Succeed:

- Standardised designs for multiple EV station setups.

- Low tooling investment for modular components.

- Scope for customisation and innovation in EV-specific plastic products.

Industrial Plastics in Water and Waste Management

Industrial plastic products are increasingly used in urban infrastructure and industrial applications for water management:

- Pipe systems and ducting: HDPE and PVC pipes are used for clean water supply, sewage networks, and irrigation.

- Protective covers and access points: FRP gratings and plastic access covers are corrosion-resistant and lightweight, suitable for treatment plants.

- Chemical-resistant tanks: Plastics are essential for handling effluents and industrial chemicals safely.

Business Opportunity: As India continues to upgrade municipal infrastructure and industrial wastewater treatment facilities, the demand for durable, low-maintenance industrial plastics is increasing steadily.

Why This Is Attractive for MSMEs:

- Repetitive orders from municipalities and industrial parks.

- Standardised products with high margins.

- Import substitution potential in specialised chemical-resistant products.

Emerging Industrial Plastic Manufacturing Opportunities in Smart Grids

Emerging Industrial Plastic Manufacturing Opportunities in Smart Grids

Smart grid projects in India are expanding across urban and rural areas. Industrial plastics play a critical role in:

- Cable management systems: Insulating conduits, trays, and trunking solutions reduce installation time and improve safety.

- Protective housings for sensors and control units: UV-stabilised plastics prevent degradation under outdoor exposure.

- Modular panels for substations: Lightweight FRP panels allow faster construction and easy maintenance.

Business Potential: The ongoing digitalisation of power networks drives consistent demand for high-quality plastic products designed for long service life and low maintenance.

Why MSMEs Can Capitalise:

- Ability to supply customised modular solutions to EPC contractors.

- High repeat demand from expansion and maintenance cycles.

- Opportunity to innovate in flame-retardant, UV-resistant, and insulating plastic solutions.

Import Substitution Opportunities

India continues to rely on imported high-specification industrial plastics for certain applications, particularly in:

- FRP gratings for heavy-duty power plants and chemical installations.

- HDPE multi-duct systems for telecom and power infrastructure.

- Flame-retardant, UV-stabilised, and high-pressure resistant plastics.

MSMEs focusing on quality manufacturing, certifications, and compliance with national and international standards can gradually replace imports and capture domestic market share, creating stable, long-term business growth.

Why This Is Important:

- Supports India’s “Make in India” initiative.

- Reduces project costs for utilities and contractors.

- Provides opportunities for niche product development with high margins.

Technological Trends Driving Industrial Plastic Manufacturing Opportunities

- Advanced Extrusion and Molding Technologies

- Improved precision and durability for HDPE ducts, FRP gratings, and customised enclosures.

- Enables production of multi-duct systems and flame-retardant components.

- Composite Materials

- Combination of FRP, thermoplastics, and additives offers superior corrosion resistance, thermal stability, and load-bearing capacity.

- Critical for renewable energy structures, EV infrastructure, and chemical handling.

- Automation and Process Efficiency

- Automated extrusion, moulding, and finishing systems reduce production costs and enhance product quality.

- Facilitates scalability for MSMEs targeting large national projects.

- Sustainability and Recyclable Plastics

- Growing awareness of sustainability encourages use of recyclable and environmentally friendly plastic compounds.

- Opens niche opportunities for green-certified industrial plastics in energy and infrastructure projects.

Industrial Plastic Manufacturing Opportunities in Modular and Prefabricated Solutions

Modular and prefabricated systems are becoming standard in power, renewable energy, and industrial projects. Plastics offer significant advantages:

- Lightweight construction materials reduce transport and handling costs.

- Quick assembly and disassembly for temporary or semi-permanent installations.

- Long-term durability with minimal maintenance.

MSMEs can produce prefabricated panels, protective housings, cable trays, and ducting systems designed for rapid deployment, creating a strong market segment.

Government Incentives and Policies Supporting Industrial Plastic Manufacturing Opportunities

The Indian government’s initiatives bolster the Industrial Plastic Manufacturing Opportunities sector:

- Smart Grid and Renewable Energy Programs: Subsidies and procurement support for equipment and components.

- MSME Schemes: Financial and technical assistance to establish manufacturing units.

- Make in India & Import Substitution Policies: Encourage domestic production and reduce reliance on imported industrial plastics.

- Green Energy and Sustainable Infrastructure Projects: Prefer suppliers with quality-certified and environmentally friendly products.

These programs create a supportive environment for MSMEs to enter, grow, and scale operations in industrial plastic manufacturing.

Lessons from Successful MSME Plastic Manufacturers

Entrepreneurs can draw valuable lessons from existing MSME success stories:

- Focus on Niche Industrial Applications

- Specialised products for power, energy, and water management reduce competition.

- Emphasise Quality and Compliance

- Meeting safety, fire, and chemical standards ensures repeat orders and long-term contracts.

- Develop Strong Relationships with EPC Contractors

- Strategic partnerships lead to steady demand and project-specific product development.

- Gradual Capacity Expansion

- Start with regional supply, establish reliability, and scale nationally as orders grow.

- Invest in R&D and Product Innovation

- Offering customized, modular, or high-performance solutions differentiates MSMEs in a competitive market.

Role of Feasibility Studies and Consultancy

Before venturing into industrial plastics manufacturing, detailed market research and feasibility analysis are crucial. Firms like NIIR Project Consultancy Services (NPCS) assist entrepreneurs by preparing:

- Market survey reports tailored to industrial plastic segments

- Detailed Techno-Economic Feasibility Reports (DPRs) covering process selection, capacity planning, machinery, and financial projections

- Import substitution and domestic market potential studies

- Guidance on regulatory compliance and quality certification

This structured approach ensures informed decision-making, reduces risks, and helps secure financing from banks or investors.

Future Outlook of Industrial Plastic Manufacturing Opportunities

India’s Industrial Plastic Manufacturing Opportunities are expected to grow steadily due to:

- Expanding power and energy infrastructure

- Increasing renewable energy and green fuel projects

- Rise in EV adoption and supporting infrastructure

- Government-backed import substitution and Make in India initiatives

- Growing need for low-maintenance, durable, and high-performance industrial plastics

MSMEs and startups that focus on quality, innovation, and strategic partnerships are well-positioned to capitalize on these opportunities. Products such as HDPE ducts, FRP gratings, cable conduits, protective enclosures, and modular prefabricated components are likely to see sustained demand for the next decade.

How Power Sector Reforms Are Boosting Plastic Demand

Government initiatives such as:

- Smart grid development

- Distribution reforms

- Renewable energy integration

- Infrastructure modernisation

are increasing outdoor installations and cable density. This shift directly supports higher usage of industrial plastic products over traditional materials.

Role of NIIR Project Consultancy Services (NPCS)

Before investing, proper planning and feasibility analysis are essential.

NIIR Project Consultancy Services (NPCS) helps entrepreneurs by preparing Market Survey and Detailed Techno-Economic Feasibility Reports (DPRs).

These reports include:

- Manufacturing process details

- Market demand assessment

- Product mix and capacity planning

- Machinery and raw material requirements

- Financial projections and profitability analysis

This ensures informed decision-making before capital investment.

Lessons from Successful MSME Plastic Manufacturers

India’s industrial plastic sector has many MSME success stories built on:

- Infrastructure-focused niche products

- Consistent quality

- Strong EPC and utility relationships

- Gradual capacity expansion

Instead of competing in consumer plastics, these businesses focused on stable industrial demand.

How NIIR Project Consultancy Services (NPCS) Supports Entrepreneurs

Starting an industrial plastic manufacturing unit requires careful planning, market understanding, and financial clarity.

NIIR Project Consultancy Services (NPCS) supports entrepreneurs, MSMEs, and investors by preparing Market Surveys and Detailed Techno-Economic Feasibility Reports (DPRs) specifically tailored to industrial manufacturing projects.

NPCS reports typically cover:

- Manufacturing process and technology selection

- Market demand analysis and product positioning

- Capacity planning and product mix

- Machinery, raw material, and utility requirements

- Project cost estimation

- Financial projections and profitability analysis

This structured approach helps entrepreneurs reduce risk, secure bank finance, and make informed investment decisions before setting up a manufacturing unit.

Key Government Reference Portals

Entrepreneurs should track official updates from:

- Ministry of Power- https://powermin.gov.in

- Ministry of MSME- https://msme.gov.in

- Invest India- https://www.investindia.gov.in

- DPIIT- https://dpiit.gov.in

- NITI Aayog – https://www.niti.gov.in

Frequently Asked Questions (FAQs)

Q1. Is industrial plastic manufacturing suitable for first-time entrepreneurs?

Yes. With proper feasibility analysis and product selection, industrial plastic manufacturing is well-suited for first-time MSME entrepreneurs.

Q2. Which power sector projects use industrial plastics the most?

Substations, renewable energy parks, underground cabling projects, smart grids, and transmission corridors are major consumers.

Q3. Is there long-term demand stability in this sector?

Yes. Power and energy infrastructure projects create long-term, non-cyclical demand compared to consumer-driven markets.

Q4. Can MSMEs compete with large manufacturers?

Absolutely. MSMEs succeed by focusing on niche products, customization, and regional project supply.

Conclusion

Industrial plastic manufacturing linked to India’s power and energy sector offers a stable, scalable, and future-ready business opportunity. With strong infrastructure demand, import substitution scope, and MSME-friendly investment levels, products such as HDPE ducts, FRP gratings, cable conduits, and protective enclosures are well-positioned for long-term growth.

For entrepreneurs seeking manufacturing opportunities backed by national infrastructure development, industrial plastics represent a reliable path forward.