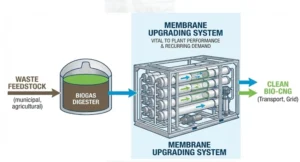

The clean-energy transition in India is frequently viewed through the prism of power production, electric transportation or hydrogen greenness. Less noisy and with much less press coverage, yet another industrial opportunity is emerging, though, biogas upgrading and Bio-CNG purification, which is fueled by one essential enabler, gas separation membranes.

For entrepreneurs and MSME investors who understand industrial value chains, membrane manufacturing is emerging as a rare combination of technology depth, recurring demand, and import substitution logic.

Both based on the Annual Report 2024-25 published by the Ministry of New and Renewable Energy, Government of India, it is evident that there has been a structural trend in that biogas and compressed biogas plants are growing more rapidly than high-performance purification systems domestically. The core of this imbalance is that of membrane technology, which is currently imported in large amounts, is technically specialised, and is vital to the performance of the plant.

Why Membranes Matter More Than Digesters

Most first-time entrepreneurs entering the biogas space focus on digesters, feedstock logistics, or gas bottling. In practice, the economic viability of a Bio-CNG plant is decided downstream, at the upgrading stage. Raw biogas, with its high CO₂, moisture, and trace contaminants, has limited commercial value. Membrane systems determine methane recovery, purity consistency, and operating cost—three variables that directly affect plant cash flow.

The national data shows a steady increase in operational and under-construction Bio-CNG plants across municipal, agricultural, and industrial waste streams. What it also shows—less explicitly but more importantly—is that a majority of these plants rely on imported membrane modules or fully imported skids. This dependence is not accidental; it stems from the absence of scaled domestic membrane manufacturing.

For manufacturing-led entrepreneurs, this gap is the opportunity.

Demand Expansion Is Policy-Backed and Asset-Driven

Unlike speculative clean-tech segments, biogas and Bio-CNG growth is anchored in physical infrastructure. Waste aggregation systems, municipal contracts, agri-residue supply chains, and gas offtake agreements create locked-in demand. Once a plant is built, membranes are not a one-time sale—they are consumable industrial components with replacement cycles.

Sectoral analysis from national renewable energy data indicates three demand drivers converging:

- Expansion of city gas distribution networks requires alternative gas sources

- Municipal and agro-industrial waste-to-energy mandates

- Transport fuel substitution using Bio-CNG

Each driver increases the installed base of upgrading systems, and each installed system requires membranes that meet specific separation performance thresholds.

Import Dependence: A Clear Manufacturing Signal

Biogas upgrading involves membrane modules, which are mostly polymeric hollow fibre or flat-sheet modules, which are mostly imported. Domestic manufacturers put together skids, make pressure vessels or combine controls yet the very heart of a separation, the core, is imported.

From an industrial economics standpoint, this is significant. Membranes account for a disproportionate share of system value while representing a small physical footprint. That combination—high value density and repeat demand—has historically been attractive for MSME manufacturing, provided process control and quality systems are robust.

The import reliance also exposes plant operators to currency volatility, lead-time risk, and limited customisation. These pain points create natural demand for domestic suppliers who can deliver consistent performance with faster service cycles.

Read Also: Khadi as a Scalable Manufacturing Business: New Opportunities in Khadi Industry in India

Snapshot of the Opportunity Landscape

| Segment | Current Supply Pattern | Demand Trajectory | Manufacturing Gap |

| Biogas Digesters | Largely domestic | Stable growth | Low |

| Upgrading Skids | Mixed (assembly local) | Strong growth | Moderate |

| Membrane Modules | Predominantly imported | High, recurring | High |

| Replacement Membranes | Imported | Locked-in demand | Very high |

To entrepreneurs, the table tells a simple tale; the closer to the end of the value chain, the greater the barrier to entry; the greater the stable the margins.

Project Opportunities for New Manufacturers

Polymeric Gas Separation Membrane Manufacturing

This is the core opportunity. The production of hollow-fibre membranes or flat-sheet membranes in the separation of CO 2-CH 4 needs processing knowledge of polymer, controlled spinning lines or casting lines, and thorough quality control tests. Capital intensity is not high as in heavy engineering, but technical discipline is a must. Constant permeability and selectivity Plants could be developed with constant permeability and selectivity to serve biogas as well as the same gas-separation markets.

Membrane Cartridge & Module Assembly Units

Module assembly provides a safer entry point to the business entrepreneurs who want to venture into the business at a slow pace. The imported membrane sheets or fibres can be packaged into cartridges, potted, tested and made available in the domestic market. In the long run, it is possible to implement backward integration in the manufacturing of the membranes. This model on paper is a reflection of how numerous thriving Indian industrial companies ventured in to complicated industries.

Retrofit & Replacement Membrane Supply Business

Bio-CNG facilities that are currently in place constitute a captive after market. There are good margins in replacement membranes, performance upgrades as well as customised modules that can be designed based on the characteristics of Indian feedstock. This segment is more rewarding to application engineering and customer intimacy than scale.

Integrated Upgrading Skid Manufacturing with In-House Membranes

Entrepreneurs with higher capital appetite can integrate membrane manufacturing with skid fabrication. The commercial advantage lies in performance guarantees and lifecycle cost control—key decision factors for plant developers.

Lessons from Indian Industrial Leaders

The examples of Mukesh Ambani (Reliance Industries) and Gautam Adani (Adani Group) in energy-transit industry can be explained with the same logic: the mastery over vital inputs prior to the growth of output companies. Their size is unrivaled, but the MSMEs need to learn a lesson, that is, to own the bottleneck part, rather than the assembly line.

Nearer to the MSME ecosystem, there is a group of waste-to-energy solution providers that have developed through specialising in a single important subsystem instead of providing generic turnkey plants. Their promoters invested in deep-seated marketing over broad marketing to develop strong areas of defense that generated long term contracts.

The lesson to the first-generation entrepreneurs is to not succumb to the urge of doing everything. Develop a capacity where vulnerability remains the greatest.

Profitability Logic and Risk Awareness

From a feasibility consultant’s perspective, membrane manufacturing economics hinge on four factors:

- Process Yield Stability – Small deviations in membrane quality can cascade into performance failures. Investment in testing infrastructure is essential.

- Standardisation vs Customisation Balance –The excess use of customisation removes benefits of scale; excessive use of standardisation restricts market fit.

- Replacement Cycle Visibility – Recurring demand supports the stability of cash-flow..

- Technology Obsolescence Risk –The technology of this industry is characterized by the concept of incremental enhancement; there are not radical changes, which minimizes the risk of stranded assets.

Niir project Consultancy Services (NPCS) regularly appraises such projects using Market Survey cum Detailed Techno-Economic Feasibility Reports, which are the results of demand analysis coupled with process analysis, capacity planning, selection of machinery, and complete financial modelling. We do not aim at promoting industries, but only to make entrepreneurs realize where capital will work hardest and longest.

Why This Industry Fits New Entrepreneurs

The production of membranes is at the crossroads of clean energy, new materials, and industrial consumables. It enjoys policy-based demand and is not reliant on subsidies and it rewards operational efficiencies over brand expenditure. Significantly, it provides gradual entry, both on assembly and full production, hencemaking it suitable for MSMEs with ambition and patience.

National renewable energy planning documents available through the Ministry’s portal (mnre.gov.in) consistently emphasise decentralised energy and waste-to-value pathways. The use of membranes is not an edge technology in this vision but it is a fundamental enabler..

FAQ

Are first-generation entrepreneurs too technical to engage in membrane manufacturing?

It is not inaccessible yet technical. Through proper process consultants, skilled human resource and gradual investments, the MSMEs can join.

How large is the domestic market realistically?

The market is defined by installed and upcoming Bio-CNG plants, each requiring initial membranes and periodic replacements. Demand is cumulative, not one-off.

Are imports likely to disappear soon?

Not immediately. However, domestic suppliers who meet performance benchmarks can rapidly displace imports on cost and service reliability.

What is the biggest commercial risk?

Underestimating quality control costs. Membranes are unforgiving of shortcuts.

Can this business scale beyond biogas?

Yes. Similar membranes are used in hydrogen separation and industrial gas purification.

Closing Perspective

Biogas and Bio-CNG membrane manufacturing is not a fashionable startup idea—it is an industrial one. That is precisely its strength. For entrepreneurs who think in terms of feasibility, lifecycle demand, and value-chain control, this sector offers a rare chance to build a technically respected, commercially resilient manufacturing business aligned with India’s energy transition.