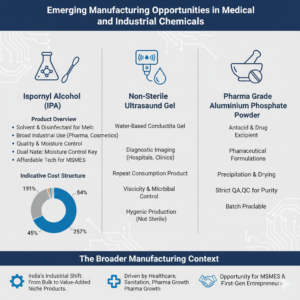

The manufacturing environment in India is changing silently though conclusively. In Emerging Manufacturing Opportunities heavy engineering and auto parts, the opportunity layer is proving in the specialty chemicals, medical consumables, and alternative-use industrial products. These are the segments that are not headline-making, but lie at the crossroads of stable demand, scalable production, and good margins, exactly where first-generation manufacturers, MSMEs and long-term investors would be expected to win.

This article analyses three of these products as independent manufacturing and business opportunities including Isopropyl Alcohol (IPA), Non-Sterile Ultrasound Gel, and Pharma Grade Aluminium phosphate Powder.. Industries of the different products are dissimilar but the common features in all of them are repetitive demand, technology that can be handled and that the products are relevant to the Indian self-reliance and healthcare-based growth narrative.

The Broader Manufacturing Context

The industrial development of India in the past ten years has been more consumption-based than export-oriented. The growth of healthcare, awareness of sanitation, development of pharmaceutical capacity, and manufacturing of chemicals connected with infrastructure are transferring the specialty manufacturing into the mainstream realm. The small and mid-sized plants are not restricted to commodity production anymore; they are shifting to niche and value-added products with guaranteed offtake.

It is against this background that the following products can be distinguished on the basis of commercial logic.

-

Isopropyl Alcohol (IPA)

Product Overview and Applications

Isopropyl Alcohol is a solvent of white colour that dissolves quickly and is commonly used as a cleaning agent and a disinfectant. It has a much broader industrial presence, even though individual swabs and hand sanitisers are its most commonly known medical applications. IPA is also needed in the cleaning of electronics, pharmaceutical formulations, cosmetics, inks and surface coatings.

What is especially appealing about IPA is that it is both a bulk chemical and a specialty input. This enables manufacturers not to greatly rely on one group of customers by serving numerous industries.

Manufacturing and Production Insights

The indirect or direct hydration of propylene is normally used to produce IPA. The indirect hydration route is typically favoured by Indian plants, which is consistent with propylene availability that is related to the refinery.

The stages of production include a necessary reaction, distillation and dehydration. The chemistry is already proven but quality consistency and the control of moisture is paramount- particularly in pharmaceutical and electronics grade IPA.

The technology is affordable to the MSMEs with the experience of handling chemicals because a medium-scale plant can be run using standardised reactors and distillation columns.

Raw Materials and Processing Considerations

Raw material is mainly propylene, and in the process route, it is accompanied by sulfuric acid or solid catalysts. Solvency, energy conservation and wastage of water have great effects on the cost of operations.

Availability of a steady supply of propylene is usually a determinant of long-term competitive nature and that is why most manufacturers of IPAs favour areas that are close to refineries or petrochemical centres.

Demand Drivers and End-Use Industries

The core demand base is constituted by healthcare institutions, diagnostic laboratories, pharmaceutical companies, electronic assembly, and FMCGs companies. Hygiene standards in the aftermath of the pandemic have irreversibly increased the minimum consumption, although emergency demand evened out.

The manufacturing of electronics especially semiconductors and PCB assembly- is becoming one of the consistent sources of growth since the IPA has become crucial in the precision cleaning.

Market Size, Growth Outlook, and Profitability

The IPA demand in India has been increasing by the high single digits every year, and the pharma and electronics grades have been increasing at a faster rate. Margins are not volatile because the consumption cycles are regular and the risk of substitution is low.

Indicative Cost Structure

| Cost Component | Share (%) |

| Raw Materials | 55 |

| Utilities & Energy | 15 |

| Labor & Overheads | 10 |

| Packaging & Logistics | 10 |

| Compliance & Others | 10 |

-

Non-Sterile Ultrasound Gel

Product Overview and Applications

Non-sterile ultrasound gel is a conductive water-based substance in diagnostic imaging. Non-sterile gel is administered in the routine ultrasounds of hospitals, clinics, and diagnostic centres, unlike sterile variants, which are utilised in invasive procedures.

Its business attractiveness is in the repeat consumption, local production practicability and in the limited technological complexity.

Manufacturing and Production Insights

It is produced by mixing purified water with carbomers or other like gelling agents, humectants, preservatives and pH stabilisers. This is a batch process that does not involve high-pressure systems and temperature reactions.

Instead of being sterile, quality control is concerned with the uniformity of the viscosity, microbial limits and compatibility of the skin, which makes regulation easier.

Raw Materials and Processing Considerations

The main ingredients are deionised water, carbopol-type polymers, glycerin or propylene glycol, preservatives and neutralising agents. Clean-rooms are not prerequisite, however, hygienic production measures are significant.

Packaging is an important factor in branding and acceptance in the market, normally in squeeze bottles or sachets.

Demand Drivers and End-Use Industries

The diagnostic imaging capacity in India has grown at a very fast pace, as it is fueled by preventive healthcare, insurance rates, and tier-2 and tier-3 hospitals. The volume of gel used in each ultrasound procedure is linked to demand instead of being discretionary.

Outtake is ensured by the government-subsidized health schemes and the chains of privately based diagnosis.

Market Size, Growth Outlook, and Profitability

The non-sterile ultrasound gel market increases in line with the diagnostic infrastructure, which is generally between 8 and 10 per cent per year. However, there are low entry barriers and the success is determined by long-term success of brand trust and distribution reach.

Indicative Cost Structure (Ultrasound Gel)

| Cost Component | Share (%) |

| Raw Materials | 35 |

| Packaging | 25 |

| Labor & Overheads | 15 |

| Quality & Compliance | 10 |

| Marketing & Distribution | 15 |

Text-Based Growth Outlook Pie

Hospital Diagnostics ████████████ 50%

Private Clinics ███████ 30%

Mobile & Rural Units ████ 20%

-

Aluminium Phosphate Powder (Pharma Grade)

Product Overview and Applications

Aluminium phosphate in the form of powder is widely utilised as an antacid active ingredient and vaccine adjuvant. Pharma-grade material is required to be highly pure, with a controlled particle size and strictly adhering to the pharmacopeial requirements.

This product is positioned at the intersection of chemicals and pharmaceuticals that are rewarding yet need to be executed in a disciplined manner.

Manufacturing and Production Insights

The process of manufacturing entails the reaction between phosphoric acid and aluminium hydroxide under controlled conditions, then it is filtered, dried and milled. The difficult part is not in chemistry, but in controlling the processes and documentation.

Read Project Detail: Phosphoric Acid from Rock Phosphate (By Using 25% Venyl Sulphon Content Sulphuric Acid and Hydrochloric Acid)

Even when not manufacturing finished formulations, pharma-grade plants should be running under GMP-congruent systems.

Raw Materials and Processing Considerations

Aluminium hydroxide and phosphoric acid are important inputs that are easily accessible. Nevertheless, impurity profiling, trace metal control and batch reproducibility have been shown to have a great impact on acceptance by pharmaceutical buyers.

It is mandatory to invest in the analytical laboratories and validation procedures.

Demand Drivers and End-Use Industries

The pharma-formulation sector, vaccine manufacturing industries and drug exporting companies of India are the drivers of demand. Due to the policy level support of domestic API and excipient sourcing, local suppliers are more preferred.

Market Size, Growth Outlook, and Profitability

Although the volumes are lower than those of bulk chemicals, the margins are higher. Growth is consistent with the pharmaceutical output being in the 7-9 percent range with a potential of export contributing to this growth.

Demand Comparison Table

| Product | Demand Stability | Margin Potential | Scalability |

| IPA | High | Medium | High |

| Ultrasound Gel | Medium-High | Medium | Medium |

| Aluminium Phosphate | High | High | Medium |

Read Our Book: The Complete Technology Book on Aluminium and Aluminium Products

Role of Project Feasibility and NPCS

Feasibility assessment for entrepreneurs who consider these opportunities is usually a defining success factor as opposed to the availability of capital. Niir Project Consultancy Services (NPCS) is involved in this early decision making throughthe preparation of Market Survey cum Detailed Techno-Economic Feasibility Reports. These reports normally include manufacturing operations, source of raw materials, plant design planning, the capacity choice, and the financial estimates. This type of analysis allows entrepreneurs to evaluate the commercial feasibility and scalability of starting a new industrial unit before investing in it.

Lessons from Indian Industrial Leaders

Entrepreneurs can find inspiration in such leaders as Baba Kalyani of Bharat Forge the developer of scale by process excellence and customer trust, and Dilip Shanghvi of Sun Pharma the developer of the economics of disciplined product selection and backward integration in pharmaceutical manufacturing. Their logic of making decisions is centred on repeat demand, investing early on quality and scaling up cautiously directly to the ventures of specialty chemicals.

Frequently Asked Questions

Can first-generation entrepreneurs survive in chemical manufacturing?

Yes, when the selection of the products is niche based and compliance is considered as a core investment and not as a cost.

What product has the best break-even?

Non-sterile ultrasound gel usually breaks down even within a shorter period of time as it is less capital intensive.

What is the significance of location choice?

IPA: This is crucial owing to the logistics of raw materials; ultrasound gel: This is less restrictive.

Are these products export oriented?

There is clear export potential of IPA and phosphate of aluminium in terms of quality certification.

Conclusion: Strategic Learnings to Entrepreneurs.

In the contemporary world of manufacturing, it is not about size at the start but rather accuracy when it comes to product selection. The non sterile ultrasound gel, Isopropyl Alcohol and aluminium phosphate powder are all risk-reward profiles, but all of them are consistent with India consumption-driven industrial growth.

As long as entrepreneurs take a technical disciplined approach to the sectors with realistic capacity planning and long-term market insights, they are in a good position of developing strong manufacturing enterprises. The chance is no speculative fact but is already fixed in the hospitals, laboratories, factories, and pharmacies throughout the country.