Maize Processing Business in India Argo-processing industry is going through a structural transition from raw commodity trading to value added manufacturing. Among all the cereal crops, maize has become one of the most commercially feasible raw materials for industrial processing. With annual production in excess of 36 million metric tonnes, India has a sound base for supply. However only a small percentage of this maize is processed into high-value derivatives such as starch, liquid glucose, dextrose and sorbitol.

For MSME entrepreneurs, this production-processing gap is an opportunity for scale and profitability.

According to the Ministry of Agriculture & Farmers Welfare, the production of maize has been stable and increasing. At the same time, the Ministry of Food Processing Industries registers growing demand for processed foods, confectionary, bakery products, and milk products. Pharmaceutical expansion supported by the Department of Pharmaceuticals has further worked to strengthen the demand for dextrose and sorbitol for use in IV fluids and medicinal syrups.

The opportunity is evident: the availability of raw material is good, but processing capacity is underdeveloped.

Understanding the Industrial Demand for Maize Derivatives

Maize wet milling enables separation of starch, protein, fibre and germ. From starch a number of industrial derivatives are produced. These derivatives are used in various sectors, which makes dependency on one industry less.

Major industrial applications are:

- cup Native starch, textile warp sizing, paperboard manufacturing

- Liquid, confectionery, bakery filling, ice creams

- IV fluids and fermentation processes containing dextrose monohydrate

- Sorbitol in toothpaste, cosmetic creams and vitamin syrups

Because of diversified demand in food, pharma, textile and FMCG industries, maize processing units have an advantage.(Maize Processing Business in India)

Production vs Processing: Where the Opportunity is

About 36-38 million metric tonnes of maize is produced annually in India. However:

- Around 55–60% goes to poultry feed

- About 10 – 15% are used for direct consumption

- Only 20-25% goes through an industrial processing

This imbalance implies that the constraint is not raw material, but processing infrastructure.

For entrepreneurs this means:

- Lower procurement risk

- Very high domestic industrial demand

- Scope for expansion without relying so heavily on exports

Import Substitution: A Great Profit Driver

Despite adequate maize production, speciality derivatives are still imported into India, especially high purity sorbitol and glucose syrups. Pharmaceutical clusters in Gujarat, Telangana and Himachal Pradesh often take imported supplies.

Setting up maize processing units in close proximity to these clusters can:

- Reduce logistics costs

- Increase delivery reliability

- Eliminate import lead times

- Strengthening long-term B2B contracts

Import substitution is not a strategy that helps only margins, but also is in line with India’s self-reliance manufacturing strategy.(Maize Processing Business in India)

Industry Success Stories

The expansion of existing players is indicative of the long-term viability of maize-based value addition.

Riddhi Siddhi Glico Boils Ltd., promoted by Chandrakant Patel, diversified from starch production to sorbitol and maltodextrin, and built their way into the pharmaceutical and the FMCG supply chains.

Similarly, Gujarat Ambuja Exports Ltd., led by Nagesh Agrawal, used the availability of maize domestically to scale starch and glucose derivative production.

The main point is simply this: value addition is the key to ensuring margin stability and resilience over the long run.(Maize Processing Business in India)

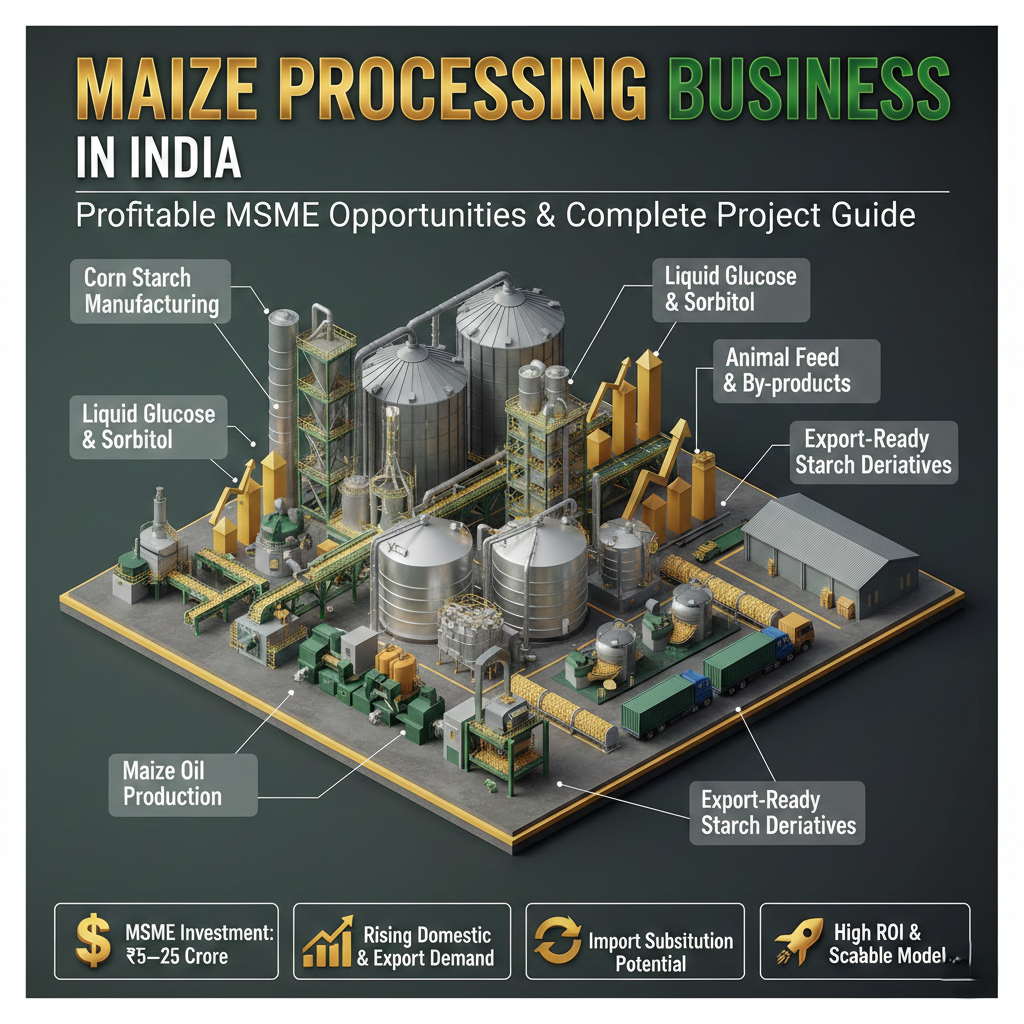

Profitable Maize Processing Business Opportunities for MSME

Entrepreneurs can choose between separate derivative plants or integrated wet milling plants.

1. Manufacturing of Native & Modified Starches

This is one of the most stable parts in the processing of maize. Textile and paper industries provide regular demand all year round. Investment requirements are moderate as compared to high purity derivatives and thus suitable for first-generation entrepreneurs.(Maize Processing Business in India)

2. Liquid Glucose Production

Liquid glucose units are for confectionery and bakery manufacturers. Since the demand for FMCG goods is still growing in India, this is a sector of constant B2B sales potential. Working capital cycles are usually manageable.(Maize Processing Business in India)

3. Dextrose Monohydrate Production

This segment demands better quality control standards but provides better margins. Pharmaceutical companies need dextrose in IV fluids and medicine. Entry into this segment is a means of strengthening long-term profitability.(Maize Processing Business in India)

4. Manufacturing Plant for Sorbitol

Sorbitol production holds great scope of import substitution. With the increase in the oral care and cosmetic industries, domestic demand is growing. Although more demanding in terms of technicality, there is a higher value realization.(Maize Processing Business in India)

Integrated Maize Wet Milling: A Strategic Plan

An integrated maize processing unit involves the production of multiple derivatives from the same stream of raw material. This helps in better utilization of capacities and profits.

An integrated plant normally derives revenue from:

- Starch

- Liquid glucose

- Dextrose

- Sorbitol

- Germ oil

- Gluten feed

By-product monetization improves overall returns of projects and reduces wastage.(Maize Processing Business in India)

Key Profitability Factors

Profitability in maize processing depends on a number of factors that are interrelated:

- Strategic plant location close to demand clusters

- Diversified product mix

- Efficient energy management

- High quality control systems

- Long term industrial supply contracts

Higher-margin derivatives yield a much higher internal rate of return than the sale of native starch alone.

Risks and Mitigation

Like any other industrial project, maize processing involves some risks. Raw Material Price fluctuation can impact on margins, particularly seasonality. Pharmaceutical grade production is strictly quality. Working capital requirements could be very high because of B2B payment cycles.

These risks can be controlled by:

- Length of supply contracts, for example, long-term maize procurement contracts

- Investment in infrastructure for laboratory testing

- Strategic Partnerships with Industrial Buyers

- Careful financial planning before project execution

Why Location is Important in Maize Processing

Location strategy is often the determining factor for whether a project will work or not. Units located near pharmaceutical, FMCG, textile, or paper manufacturing centres have a lower logistics cost and are more competitive.

Because maize is bulky and is of lower value than its derivatives, it is often more economical to process near consumption centres than to operate only near farming regions.(Maize Processing Business in India)

Long-Term Growth Outlook

The growing middle class in India is driving the processed food consumption. Pharmaceutical exports are still increasing. The oral care and cosmetic industries are on an accelerated growth curve. All these industries are in one way or the other depending on maize derivatives.

This structural demand ensures that maize-based value-added products would manage to remain relevant in the commerciality for years to come.(Maize Processing Business in India)

Conclusion

The Argo-processing industry in India presents its most viable prospects through value-added manufacturing which uses maize as a primary input. MSME entrepreneurs can develop sustainable enterprises that achieve growth because of their access to domestic production resources together with multiple industrial needs and increasing potential to replace imported products in this specific market.(Maize Processing Business in India)

The achievement of success requires organizations to develop strategic plans which determine their optimal locations and product range while maintaining financial control through structured methods. The correct execution of maize processing operations transforms into an industrial development project which supports India’s future manufacturing sector growth.

Frequently Asked Questions (FAQs)

Is maize processing suitable for first-generation entrepreneurs?

Yes, provided a detailed techno-economic feasibility study is conducted before investment.

Which maize derivative offers the highest margin?

Sorbitol and pharmaceutical-grade dextrose generally provide higher profitability compared to native starch.

Is raw material availability sufficient in India?

Yes. India produces over 36 million metric tonnes annually, ensuring supply stability.

Can MSME units compete with large manufacturers?

Yes. Regional supply advantages and reduced logistics costs help MSMEs compete effectively.

Does maize processing support import substitution?

Yes. Several specialty derivatives are still imported, offering strong domestic manufacturing potential.

What is the expected break-even period?

Typically between two to four years, depending on plant capacity and utilization levels.