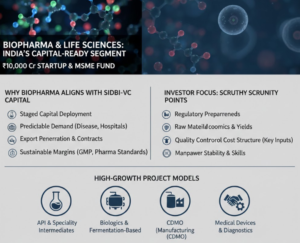

Biopharma & Life Sciences: Biopharma and life sciences manufacturing is structurally advantaged among all those sectors quietly entrained to the logic of the design of the ₹10,000 Cr Startup and MSME Fund. This does not arise from emotion or medical hype, but from the infrequent occurrence of controlled demand, export penetration, and sustainable margins characteristic of the sector.

In contrast to digital health or consumer wellness brands, biopharma manufacturing is conducted in a capital-disciplined environment that is comfortable with institutional investors. Product approval routes, GMP requirements and pharmacopoeial standards serve as intrinsic barriers to entry- weeding out the weak and ensuring the sustainability of profitability.

From an investor’s perspective, biopharma units are more of an infrastructure-type business: expensive to comply with at the outset, yet demand becomes predictable once they prove they work.

Why Biopharma Aligns Perfectly with SIDBI–VC Capital Structures

Biopharma projects align with the fund’s preference for scale over burn. The capital is usually implemented in stages which include pilot scale, validation batches, regulatory clearance and commercial expansion. This investment roadmap is a natural fit with co-investment arrangements supported by SIDBI-funded funds.

More to the point, biopharma revenues are not trend-based. Demand is anchored in:

- Chronic disease prevalence

- Hospital procurement cycles

- Export contracts to regulated and semi-regulated markets

- Contract manufacturing for global pharma companies

This makes cash flow forecasting much more credible than in most consumer-facing startups.

Read Our Biopharma Books

High-Growth Biopharma Project Models Favoured by Institutional Capital

-

API & Specialty Intermediates Manufacturing

Active Pharmaceutical Ingredients and advanced intermediates is still considered to be one of the most capital-effective biopharma entry point of MSMEs. Investors prefer units with a narrow range of molecules and predictable off-take, and avoid extensive portfolios that dilute operational concentration.

The profitability reasoning behind this is straightforward: the product mix is limited, batch consistency is increased and the export order is a repeat. The replacement projects including API that are used in the regulated export markets are closely suited to the institutional funding criteria.

-

Biologics, Biosimilars & Fermentation-Based Products

On the one hand, fermentation-based biopharma projects, enzymes, probiotics, amino acids, and biosimilars, are capital-intensive, but attract patient capital with high barriers to entry and a lack of competition.

Investors are also specifically keen in businesspeople who know how to optimise processes in order to achieve demand of products rather than mere demand of products. Even minor changes in fermentation processes can significantly affect EBITDA, which first-time founders often do not understand.

-

Contract Development & Manufacturing Organisations (CDMO)

One of the most fund-compatible biopharma structures has been developed as CDMO model. These ventures monetise capacity, compliance and reliability of execution rather than bearing the market risk.

For startups, this will minimize branding expenses and working capital pressures. It is a consistent revenue stream for investors under long-term client agreements, which is ideal for structured growth capital.

-

Medical Devices & Diagnostics Manufacturing

Although the new products are related to pharma, diagnostics kits, consumables and medical devices experience a shorter approval-to-market cycle. The benefit of these projects is that they possess less molecular risk and yet are subject to regulatory protection.

When it comes to device startups, capital providers prefer those that incorporate manufacturing + validation + distribution logic over pure trading or assembly plays.

Read Our Project report

What Investors Scrutinise in Biopharma Proposals (Beyond GMP Claims)

Many founders assume that mentioning compliance with GMP is enough. In practice, investors consider the biopharma projects through a significantly more incisive prism:

- The preparedness for regulations based on target markets, rather than generic compliance.

- Not annual claims of capacity but batch economics.

- Analysis of dependency on raw materials, particularly the imported key inputs.

- The best cost structures of quality control are normally underestimated in DPRs.

- Technical manpower is a significant operational risk that is stable.

Projects that are clear in these aspects are likely to pass through the SIDBI-related evaluation pipelines more quickly.

Learning from India’s Biopharma Wealth Creators

The winning experiences of biopharma leaders in India underscore a key lesson: scale comes after credibility, not speed.

Dilip Shanghvi has established Sun Pharma on the basis of specialty segments, complex generics, and disciplined acquisitions, rather than volume. Investment confidence was sustained by the company’s strategic clarity and its ownership of hard-to-sell products.

In the same way, Kiran Mazumdar-Shaw revolutionized Biocon with the focus on the growth being based on fermentation science, process innovation and global regulatory credibility. The start up lesson is fundamental; superficial diversification is no match for deep technical control.

For new entrepreneurs, the lesson is realistic: biopharma rewards patience, disciplined compliance, and mastery of processes far more than aggressive scaling stories do.

Why Biopharma Startups Benefit Disproportionately from Professional Feasibility Planning

Biopharma is the only industry where poor planning is punished. Minor mistakes in assumptions of yield, regulatory timelines, or validation costs can run off of the financial projections.

Here, structured feasibility thinking would not be negotiable. A project report of the biopharma at Niir project consultancy services (NPCS) is established through process first approach and mapping, which includes mapping of molecule selection, batch sizing, validation cost, manpower skill requirement and a realistic ramp-up schedule.

This type of clarity not only enables the entrepreneur to save on expensive mistakes but also provides the language that the institutional investors require when determining risk-adjusted returns.

Closing Insight: Biopharma Is Not Optional in the New Capital Cycle

With the ₹10,000 Cr Startup and MSME Fund redefining the priorities in capital allocation, biopharma ceases being a niche- it is an industrial growth pillar. Those founders who take it with scientific rigor, financial discipline and execution clarity, will find capital more approachable than it has ever been.

Biopharma does not involve ambition in this funding environment.

It is about precision.