Why railway manufacturing India

For entrepreneurs considering getting into manufacturing, the safest course of business strategy is not to follow the trends but to do some research on the bulk institutional buyers. When an organization buys in huge volumes of goods every year, it results in predictable demand and long-term business stability.

Indian Railways is one of the largest procurement driven institutions in Asia. It is not just a transport system but is mega industrial consumer purchasing steel, electrical systems, fabricated structures, wagon components, cables, signalling hardware and infrastructure equipment in extraordinary quantities.

As per Indian Railways Annual Report 2023-24, capital investment stood above ₹7.47 lakh crores whereas the freight movement was 1,588 million tonnes. Such scale automatically transits in procurement preoccupation in many manufacturing areas.

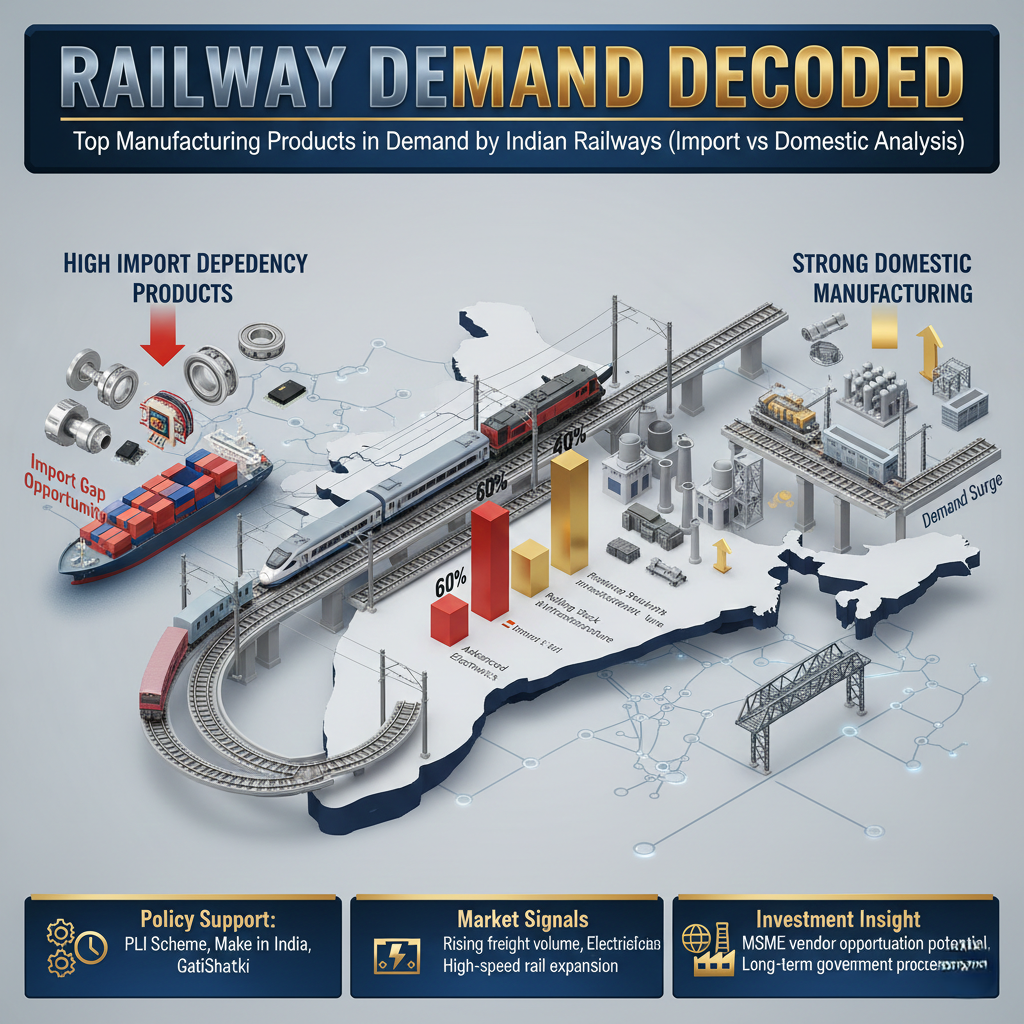

For entrepreneurs this shift from imports to domestic sourcing is a rare and time-sensitive chance.

Table of Contents

ToggleRead More: Investment Opportunities In Infrastructure Projects

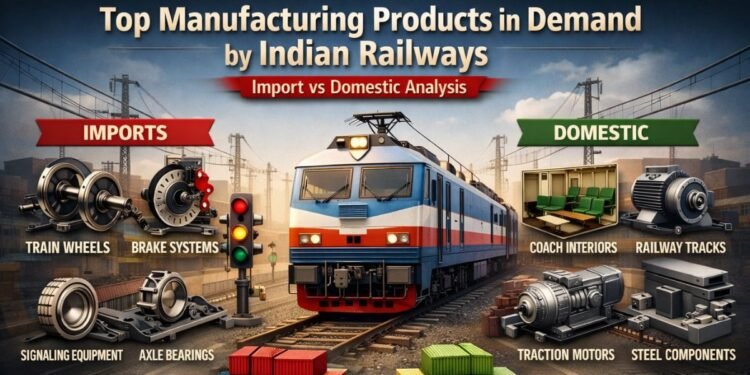

The Big Shift: From Import Dependence to Domestic Manufacturing

Historically, Indian Railways used to import specialized and high-precision components. This dependency was stimulated by low domestic technical capacity and disjunctions in supply chains.

Today the situation is very different. Domestic manufacturers have matured, quality standards have improved and volumes are large enough to warrant dedicated production facilities. Indian Railways now prefers to source domestically wherever possible because it cuts back on:

- Logistics costs

- Delivery delays

- Foreign exchange outflow

- Maintenance downtime

This transition phase – in which imports remain but are in the process of decreasing – creates ideal conditions for new manufacturers to move into.(railway manufacturing India)

Steel & Fabricated Structures: A High Volume Foundation Sector

Steel is and continues to form the backbone of railway infrastructure. While the supply of raw steel is predominantly from domestic sources, fabricated and engineered structures are a good growth area.

Every new station redevelopment, platform extension, yard expansion or foot over bridge installation requires the use of fabricated components. Demand is still there because of continued infrastructure modernization.

Key products include:

- Platform sheds and Roofing Structures

- Foot over bridge frameworks

- Gantries and portals

- Safety railings and fencing

This is a segment which has good scalability and medium barriers to entry, suitable for MSMEs with fabrication capabilities.(railway manufacturing India)

Railway Electrification Hardware: Multi-Year Visibility of Demand

With thousands of kilometres being electrified each year, railway electrification is one of the fastest growing segments. Electrification requires the consistent provide of structural and electrical hardware.

Some products in sustained demand are:

- OHE masts

- Cantilever assemblies

- Insulators

- Earthing components

Despite the fact that most of the standard items are produced domestically, there is still room for expansion with specialized assemblies. Electrification projects will also be ongoing for years to come, so there will be recurring demand.(railway manufacturing India)

Electrical Panels and Control Systems High Margin, Technical Segment

Electrical control infrastructure is the operational backbone of the railway networks. Traction substations and signalling installations rely on reliable panel installations.

In former years some precision panels had been imported because of quality issues. Now, more and more domestic manufacturers, who meet railway specifications, are preferred.

Strong potential products include:

- Traction substation panels

- Signalling control cabinets

- Power distribution boards

This segment has the need for technical expertise and provides good margins and relatively controlled competition.

Cables and Electrical Accessories: Infrastructure Multipliers

Every electrified route, upgraded station and signalling system requires a lot of cabling infrastructure. Bulk cables are already produced locally, although there still remain opportunities for special railway grade.

High-demand items include:

- Power cables

- Control cables

- Cable trays

- Heavy-duty cable glands

The advantage of going into this segment is diversification. The same production line can be used for metro rail, ports, airports and industrial infrastructure projects.(railway manufacturing India)

Wagon & Coach Components : Maintenance - Driven Growth

Indian Railways has an operation of more than two lakh freight wagons and tens of thousands of passenger coaches. Even without expansion, maintenance cycles mean continued demand.

Earlier on, some brake systems and mechanical assemblies were imported. Now, domestic sourcing is on the rise because of cost and more rapid supply advantages.

Components with opportunity include:

- Brake assemblies

- Suspension parts

- Couplers and fittings

This segment is also taking advantage of both expansion and maintenance demand, so it’s structurally stable.

Track Fasteners & Rail Hardware: Replacement Market-Must Reoccur

Track renewals for thousands of kilometres every year form ongoing demand for fastener systems.

These include:

- Elastic rail clips

- Bolts and nuts

- Washers

- Fish plates

Unlike capital equipment, fasteners are consumables that need to be replaced periodically. This makes the segment predictable and amenable for new entrants with disciplined production system.(railway manufacturing India)

Station Redevelopment & Passenger Facilities

Station modernization has created a higher demand for passenger-friendly infrastructure. Modern seating, kiosks, railings, and platform constructions are needed in large quantities.

These products are:

- Fabrication-heavy

- Design-light

- Scalable

- Applicable to regional supply

For first generation manufacturers, this can be an accessible entry segment.(railway manufacturing India)

Freight Handling & Logistics Infrastructure

Freight movement above 1,588 million tonnes need constant expansion of terminals and cargo facilities.

Opportunities exist in:

- Storage racks

- Pallets

- Dock levellers

- Cargo sheds

As the freight revenue continues to grow the infrastructure investment is consistent.

Why Entrepreneurs Should Get in Now

The existing railway ecosystem has a great combination factor:

- Large and predictable demand.

- Institutional security of payment

- Support for domestic sourcing by government

- Long term infrastructure pipeline

Import substitution is commercially viable today because domestic capability has caught up to volume demand.

Early movers receive vendor approvals, reference projects and better positioning in the tender market before competition heats up.(railway manufacturing India)

Final Insight

When an institution of the scale of Indian Railways shifts from import dependency to domestic manufacturing, it signals structural change. Entrepreneurs who align their manufacturing plans with high-volume railway procurement are building businesses around assured demand rather than speculation.

In manufacturing, the strongest foundation is predictable buyers. Indian Railways continues to be one of the most powerful and stable buyers in India’s industrial ecosystem.(railway manufacturing India)

Frequently Asked Questions FAQ

Is Indian Railways still importing products?

Yes, but the imports are steadily diminishing as domestic manufacturing gains strength.

Which railway products are most in high demand?

Steel fabrication, electrification hardware, track fasteners, cables and wagon parts are among the highest volume segments.

Are MSMEs encouraged for railway procurement?

Yes. Procurement policies are increasingly giving support to domestic MSMEs operating to quality standards.

Is manufacturing of railway bankable?

Yes. Institutional demand helps to increase financial credibility and viability of projects.

Can railway manufacturing units serve other businesses?

Most products are also used in metro rail, ports, airports and infrastructure projects – reducing the risk.