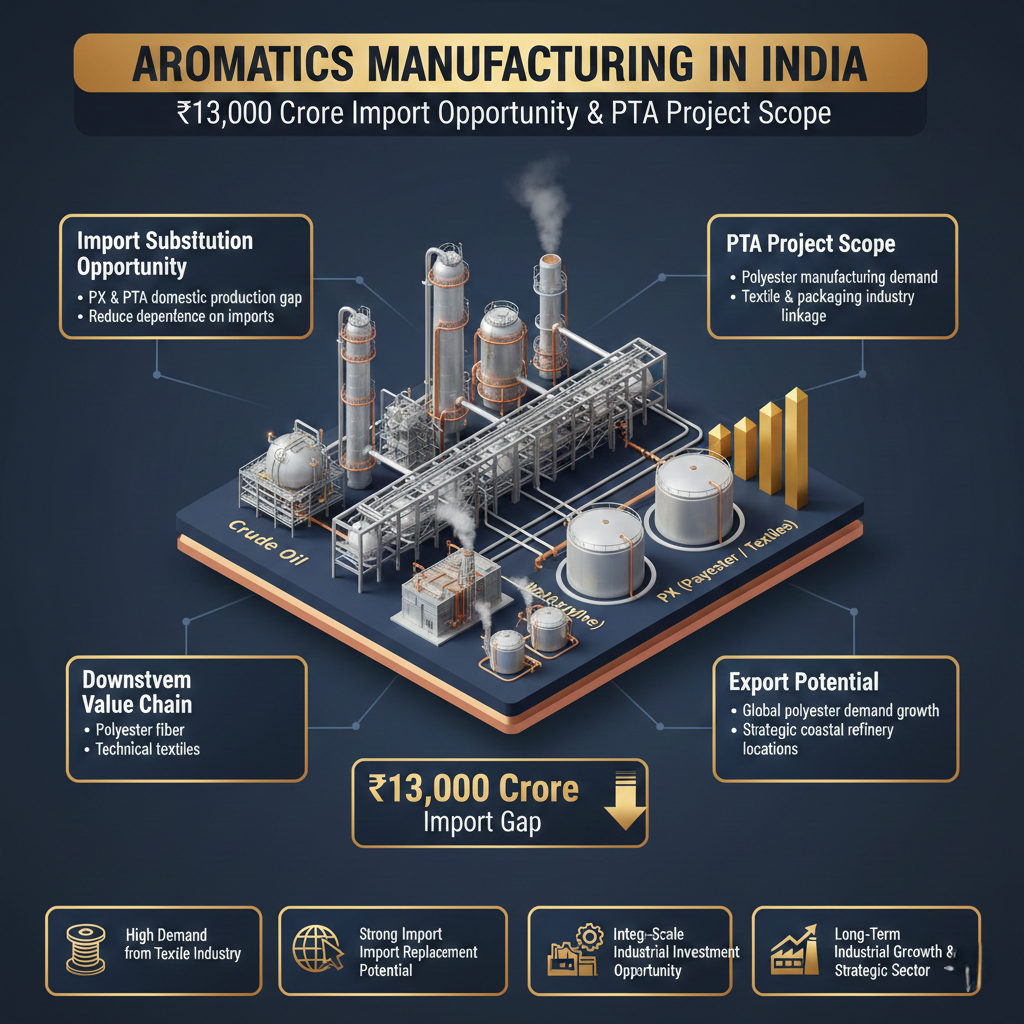

India’s petrochemical industry is at a defining point. The country needs to import Aromatics Manufacturing in India which cost more than Rs 13000 Crore because of its inability to refine the required amount despite having the largest refining capacity in the world. The essential petrochemicals which include Benzene Toluene and Xylenes (BTX) function as critical raw materials for various fields including textiles plastics packaging paints and pharmaceuticals and agrochemicals.

While the goal of India is to become self-reliant in chemicals and petrochemicals, production of domestic aromatics has come down by almost 10% from 2019 to 2024. During the same time period, there has been a significant growth in imports with a CAGR of around 14.5%. This widening demand-supply gap is an obvious investment opportunity.

The current 6% structural growth gap in aromatics isn’t a temporary situation – it is an indication of a long-term need for new manufacturing capacity.

Understanding the Aromatics Value Chain

Aromatics are 1st generation petrochemical produced primarily from naphtha reforming in oil refineries. The three main products in this category are Benzene Toluene and Xylenes.

The multiple industrial value chains that depend on these chemicals use them as foundational elements:

- Benzene is used to make styrene, phenol, nylon intermediates, detergents and pharmaceutical compounds.

- Toluene is used as an industrial solvent and can be made into benzene or xylenes.

- Paraxylene (PX), a type of xylene, is essential for producing Purified Terephthalic Acid (PTA), which is then converted into polyester fibre and PET bottles.

The textile industry and packaging industry in India both use the Paraxylene > PTA > Polyester chain as their primary production method. The sectors directly suffer from supply chain interruptions which affect the availability of aromatics.(Aromatics Manufacturing in India)

The Market Reality: Increased Imports, Decreasing Production

The installed capacity of aromatics in India reaches approximately 7.56 million metric tonnes according to Government data, while the actual production for FY 2023-24 exceeded 3.24 metric tonnes. Capacity utilization is still low, at around 43%.

At the same time, the import bill has gone higher to the tune of Rs. 13,274 Crore.

Key indicators point to the imbalance:

- Domestic production – from 4.9 MMT (2019-20) to 3.2 MMT (2023-24)

- Paraxylene imports alone was worth almost 7500 Crore

- PTA imports crossed ₹10,900 Crore

- Import growth has gone on at double digit rates

This data clearly shows that domestic supply is unable to meet downstream demand.(Aromatics Manufacturing in India)

Textile and Packaging Dependency

India’s textile industry is one of the biggest consumers of aromatics. Polyester demand is still growing because of fast fashion, export, and domestic consumption growth.

However, excessive dependence on imports from countries such as China, Taiwan and Thailand exposes Indian manufacturers to:

- Global price volatility

- Supply chain disruptions

- Subsidized producers dumping pressures

- Currency fluctuation risks

With the government having implemented Quality Control Orders (QCOs) and promotion of domestic production, this is an environment favourable to local manufacturers who can substitute for imports to meet local market demand.(Aromatics Manufacturing in India)

Read More: Business Plans / Project Profiles

Major Players of Indian Aromatics Sector

The upstream aromatics industry is controlled by integrated oil-to-chemical companies.

Reliance Industries Limited has the largest refinery complex in Jamnagar in the world and is a leader in the polyester value chain.

Indian Oil Corporation has considerable capacity in Panipat and in Paradip.

Contribution of Bharat Petroleum Corporation Limited is through its Kochi complex.

ONGC Petro additions limited, has a major petrochemical facility in Dahej.

While production upstream is concentrated, downstream manufacturing of derivatives is still fragmented. This is where there is room for MSMEs and mid-sized investors.(Aromatics Manufacturing in India)

Where the Real Investment Opportunity Lies

Instead of competing in the cracker complex billion-dollar setting, investors can focus on downstream and specialty segments.

Some promising opportunities include:

- Solvent recovery & purification units for Toluene & Xylenes

- Niche benzene derivatives like nitrobenzene and maleic anhydride

- Chlorinated aromatics for agrochemicals & pharma intermediates

- PTA and specialized production of xylene isomer for import substitution

- Polyester Recycling (rPET) in line with sustainability

Solvent recovery plants in particular, have lower capital investment and a good domestic market. With specialty derivatives, profits can be higher than with bulk commodities.(Aromatics Manufacturing in India)

Technology and Feasibility

Modern aromatics production is based on advanced processes such as:

- Naphtha reforming

- Trans alkylation

- Isomerization

Technology licensors supply tried and tested systems and domestic engineering companies offer scalable solutions for the manufacture of derivatives.

For MSMEs, the entry point in the value chain is technically feasible and financially manageable as compared to integrated refinery operations through downstream processing.(Aromatics Manufacturing in India)

Read More: Startup Selector

Financial Outlook and Long-Term Growth

The petrochemical sector is capital intensive but enjoys the benefit of economies of scale, and recovery of margins in cycles. India’s petrochemical demand is likely to almost triple by 2040 as a result of:

- Urbanization and infrastructure development

- Rising per capita income

- Increasing consumption of packaging

- Textile export growth

- Expansion of the manufacture of pharmaceuticals

With the government aiming for a $300 billion chemical industry, new investments in aromatics are in line with national industrial policy.

The present import dependency means that more domestic capacity is not a matter of choice – it is a matter of necessity.(Aromatics Manufacturing in India)

Conclusion: An Opportunity for Structural Manufacturing

India’s import bill of $13,000 Crore in the aromatics sector is a clear structural gap in domestic production. The reduction in local production is not caused by the demand but by the capacity and operational limitations.

As downstream industries are continuing to expand, the demand for domestic production of Benzene, Toluene, Paraxylene and PTA will increase.

Entrepreneurs entering this space at present – especially in downstream derivatives, solvent recovery, recycling and import substituting – can create scalable businesses, while boosting the strength of India’s chemical ecosystem.

The opportunity exists, it is real and measurable and in line with long-term industrial growth.(Aromatics Manufacturing in India)

Frequently Asked Questions (FAQ)

Why is India importing aromatics if it has refineries?

Most refineries give priority to the production of fuels. Petrochemical integration is still limited, which leads to a production shortfall.

How big is the aromatics import market in India?

It exceeded 13 thousand Crore in FY 2023-24 and it is increasing.

Which product is most import dependent?

PTA and Paraxylene are exhibiting a high degree of import dependence because of their use in polyester production.

Can MSMEs invest in the aromatics sector?

Yes. MSMEs can address solvent recovery, specialty derivatives, and recycling as opposed to bulk petrochemical cracking.

Is aromatics manufacturing a profitable business in India?

While margins are cyclical, long-term growth in demand and opportunities for import substitution make it attractive for investors.